(UX4) Budget-Building That Delivers

A Coffee Chat with Amy Omand

Our Coffee Convo

Where: Jess in her magical LA yard, Amy in her Oakland office

When: Nov 2, 2025 date

Why: Because budget season is here and between the humans I know that don't have one OR forget to include their team OR get so stressed, seemed like talking to an expert on the how to get it done could go a LONG way with what to focus on and when.

Summary

The hardest part of budgeting is almost never the spreadsheet — it's the context and the conversation! Our favorite things in things in this piece is that it isn’t just about adding numbers up correctly, it’s about the humans. You need a solid process that builds trust, context and understanding (e.g. why is one dept cutting 15% and another growing?). This approach brings in the human experience - a strong project plan that centers the human experience - with a budget that’s in service of the work, not the other way around.

What’s in it for you

You're building your first organizational budget and drowning in terms you don't understand

You want your team involved without it turning into chaos or wildly unrealistic numbers

You're facing cuts and need a process that doesn't destroy trust

You need an approach that scales to your reality (whether you're solo or managing a team)

Why Helia Chatted with Amy (Jess’ Take!)

Amy ringing in the new year on the Hanalei pier on Kauai in 2025

I learned the hard way that a bad budget process can haunt you all year long. Early in my career, I built a budget based on the most "optimistic" scenario — everything was technically accurate, but it wasn't something we could actually make happen. I spent an entire year sitting in monthly meetings reporting how we had, yet again, failed to meet our projections. It was something we just couldn't "come back from" — and it was unbelievably demoralizing.

That experience made me love a thoughtful budgeting process where we all check each other and focus on numbers we can and will actually meet.

So, I reached out to Amy (who I worked with briefly with at Revolution Foods and have loved watching her build up her fractional CFO practice across the social sector) to help set us all up with a better process.

From our Convo

Amy’s Story

Smores and stories around the fire at our annual family camp week, Lair of the Bear.

Amy got her CPA right out of college because she loved the quantitative side of things. "Business and accounting, where every debit must have an equal credit, really spoke to me," she told me. After working in public accounting and for-profit organizations (including what she describes as "a very yummy role" at Dreyer's Ice Cream), she pivoted into social impact work.

She had a moment where she considered becoming more programmatic, but ultimately decided that steady financial leadership was really what social impact organizations needed. "They need great people with those quantitative skills to help them think through the finances and steward the funds toward the most impact because, if there's no money, there's no mission."

For Amy, budgeting isn't about the spreadsheet — it's about creating a process that helps people understand and own the financial story of their organization.

She's seen it all: organizations where the budget is built top-down by the CEO and CFO and nobody feels ownership. Budget managers who had no idea they were in contraction mode until it was too late. Teams where one person asks for "the sun, moon, and stars" while another props their computer up on a cardboard box instead of buying a new laptop stand — and nobody acknowledges that both approaches exist.

Amy’s Wisdom

The main takeaway from my conversation with Amy is that the budget process matters as much as the budget itself. How you build your budget determines whether people will actually use it all year long, or whether you'll approve something in January and never look at it again.

Amy walked us through what actually makes the difference:

Clean up your chart of accounts first. Before you even start, audit how you're tracking things. "If you have an account that in a single year you've only put 30 bucks against, you don't need that account." Your system should serve decision-making first, auditing second.

Involve the people who spend the money. "If a budget is done top down by the CEO and the CFO, there's not nearly as much engagement and ownership," Amy said. But you can't just give people freedom without context. She brings current year actuals to planning meetings so everyone can see what was actually spent, then have real conversations about what to do next year.

Know which type of budget you're building. There's the annual board-approved budget, funder budgets for specific proposals, forecasts showing what's happening in real time, and long-term planning budgets. Most confusion comes from not being clear about which one you're creating.

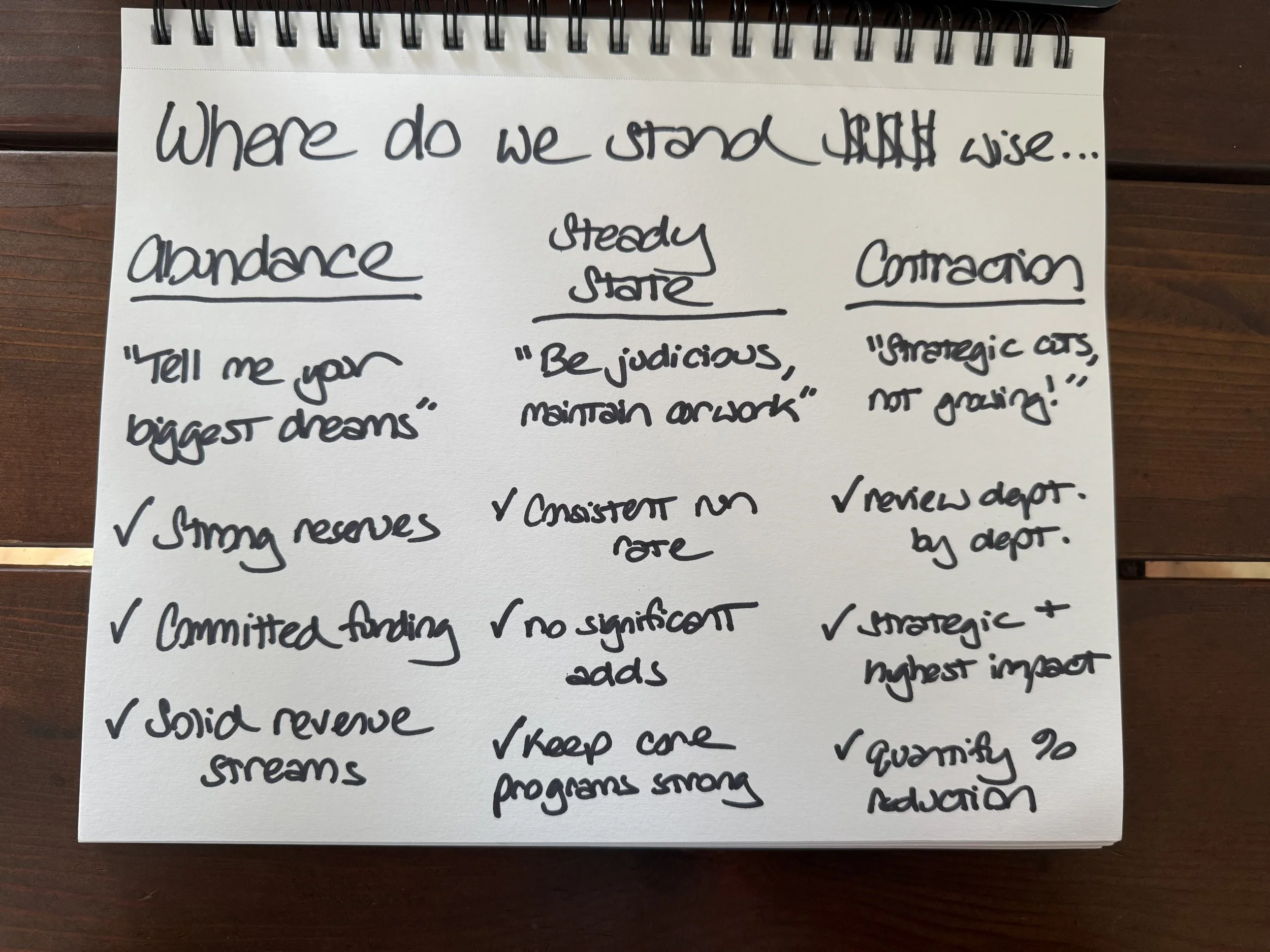

Tell the financial story first. Before anyone touches a spreadsheet, you need a shared understanding of where you actually are. Are you in abundance, steady state, or contraction mode? This determines whether you're approaching budget managers with "tell me your biggest dreams" or "we need to be really judicious." The biggest mistake? Budget managers saying "I had no idea we were in contraction mode!"

Build in time for iteration. The first few parts of any budget process are always the hardest. You're learning, catching mistakes, calibrating. Amy plans for multiple review rounds because "this is not the final budget. It obviously needs to go through several rounds of review."

Make it something you'll use all year. The budget isn't done in January. Amy recommends doing reviews with budget owners monthly or quarterly. And here's her secret: "Numbers alone don't work. When you actually add in the story — this is under budget because of XYZ, or let's dig in here because we're not sure why it's off — that's when people have their aha moments."

Questions to Ask Yourself

Are we set up so budget managers can actually see their spending throughout the year, or are we asking them to budget blind?

What's our honest financial context right now — abundance, steady state, or contraction?

Is our chart of accounts helping or hurting our decision-making? (And be honest — when's the last time you actually looked at this?)

What type of budget are we actually building, and does everyone understand the difference?

Before you can build a solid budget, you must know where you are.

GETTING TO HOW

DIY: Templates + Guides

Budget Conversation Scripts — Six scripts for your hardest moments (explaining contraction, managing unrealistic requests, presenting to board)

Non-Profit Budget Workplan — A foundational timeline that outlines all the steps you need to take - recommended over ~3 months - to get your budget ready and Board approved! (includes a bonus budget template to build off of OR compare with)

Board Budget Approval Memo - Sample budget memo for the board - with all the context AND all the numbers - including the specifics to put it into AI and get a customized memo ready for your review!

Take what’s helpful and make it your own!

More Great Stuff

Recommended Reads + Listens

Book: Managing to Change the World by Allison Green and Jerry Hauser

Podcast: Stacking Benjamins

Online Course: Financial Literacy

AI Prompts

Complicated team dynamics? A strong foundation that you just want to edit? Starting from scratch?Create a custom budget communication plan with AI!

-

Talk it out with AI — Upload the recommended docs (scroll down!) and start with: Prompt: "I'm working on my budget using Helia's [template name]. Interview me about my situation so you can help me customize it. Ask me one question at a time."Copy and paste + edit the following prompt into Claude or ChatGPT.

Paste & go — Upload the below prompt to your AI service (Claude, ChatGPT, etc.) + the recommended docs (scroll down!), and ask AI to help you fill it in

-

Last year's budget and/or actuals (can include any budgets you’ve submitted, projections you’ve shared, etc.)

Your current chart of accounts (even if it's messy!)

Monthly/quarterly financial reports from the past year

Any additional notes, presentations, emails, etc. from recent financial conversations with leadership or board

Voice memo of you talking through what's hard about this year's budget

Link to this article(!) + any of the resources (automatically added to the prompt below!)

-

I'm planning our organization's budget process and need help creating a communication plan that fits our specific context.

Here's our situation:

Our financial context is: [abundance/steady state/contraction - describe briefly]

Our team size and structure: [describe who manages budgets, how many people, their experience level]

Our biggest budget challenge has been: [describe - e.g., unrealistic expectations, lack of ownership, poor follow-through]

Specific concerns I have: [list any specific challenges or dynamics]

Based on Amy Omand's article about human-centered budgeting, help me create:

A clear "financial story" statement I can share with budget managers that honestly explains our current financial context

A timeline for our budget process (we need it complete by [DATE]) showing when to involve different people

3-4 conversation scripts I can adapt for the specific difficult moments I anticipate (customize based on my challenges above)

A plan for how we'll review and use this budget throughout the year (not just approve and forget it)

Make this practical and specific to our organization's reality. I want something I can actually use next week, not generic advice.

Additional links + resources to leverage as you answer the above -Article

Resource

Resource

Quick reminder: the more honest you are about your financial reality, the more useful the output!

About the Contributor

After getting her CPA right out of college, Amy discovered her superpower: making numbers tell stories that help organizations make better decisions. She spent years working everywhere from Dreyer's Ice Cream (which she describes as "very yummy") to social impact organizations before starting her own fractional CFO practice. Her secret is understanding that behind every budget line item is a human who needs context, ownership, and clear expectations to do their best work.

Amy works with founders and leaders as a fractional CFO. Email amy@7seatconsulting.com with "Helia Connect" in the subject line.

This article comes from a coffee chat with Amy in September 2025. These conversations form the heart of the Helia Library – because I've learned the most from doing and from talking with other doers willing to share their wisdom. We don't need to start from blank pages or do everything alone.

As always, take what's helpful, leave what's not, and make it your own.